Feature Updates

Release Date : 26th June 2025

- Invoice Enhancements

- Retail E-commerce Enhancements

- Restaurant Ecommerce – Option to Hide Order and Item Notes

- Chowly Integration Enhancements

- Retail e-commerce – Customer Contact Details on Emailed Receipt

- Purchase Order improvements

- Restaurant Ecommerce – Improved Tip application

Product Enhancements

ENHANCEMENT

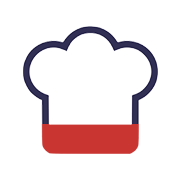

Invoice Enhancements

We’ve made a couple of improvements to enhance the readability and customization of your invoices:

- Order Note Word Wrap: Long order note texts will now automatically wrap to the next line, ensuring better formatting and readability.

- Customizable Invoice Footer: You can now add a custom message at the bottom of your invoices using the new Invoice Bottom Text setting. This is perfect for including thank-you messages, terms, or contact details. To configure the footer text, head to: Settings > Invoice Bottom Text.

|

|---|

| Invoice bottom text |

ENHANCEMENT

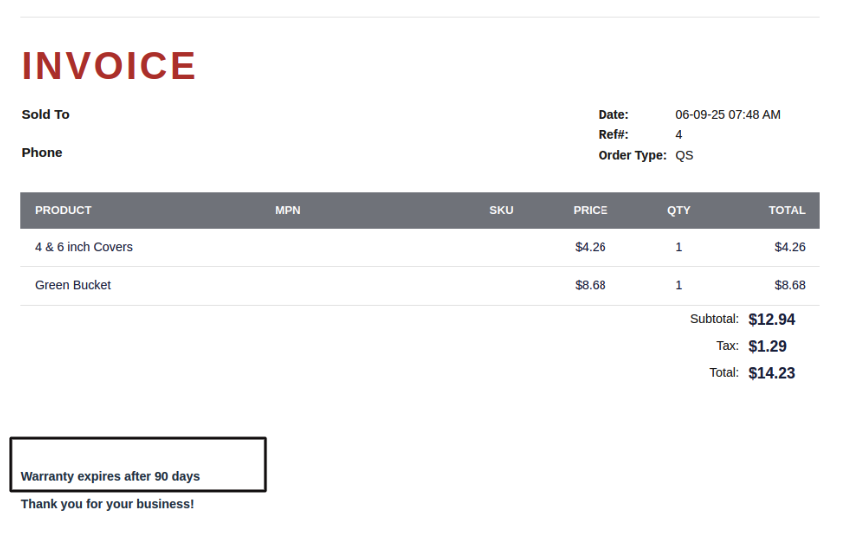

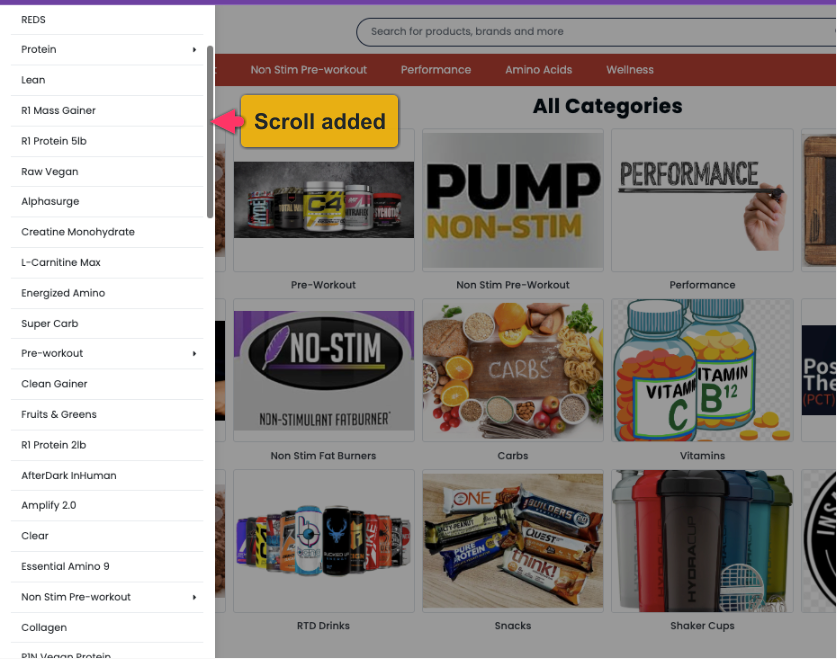

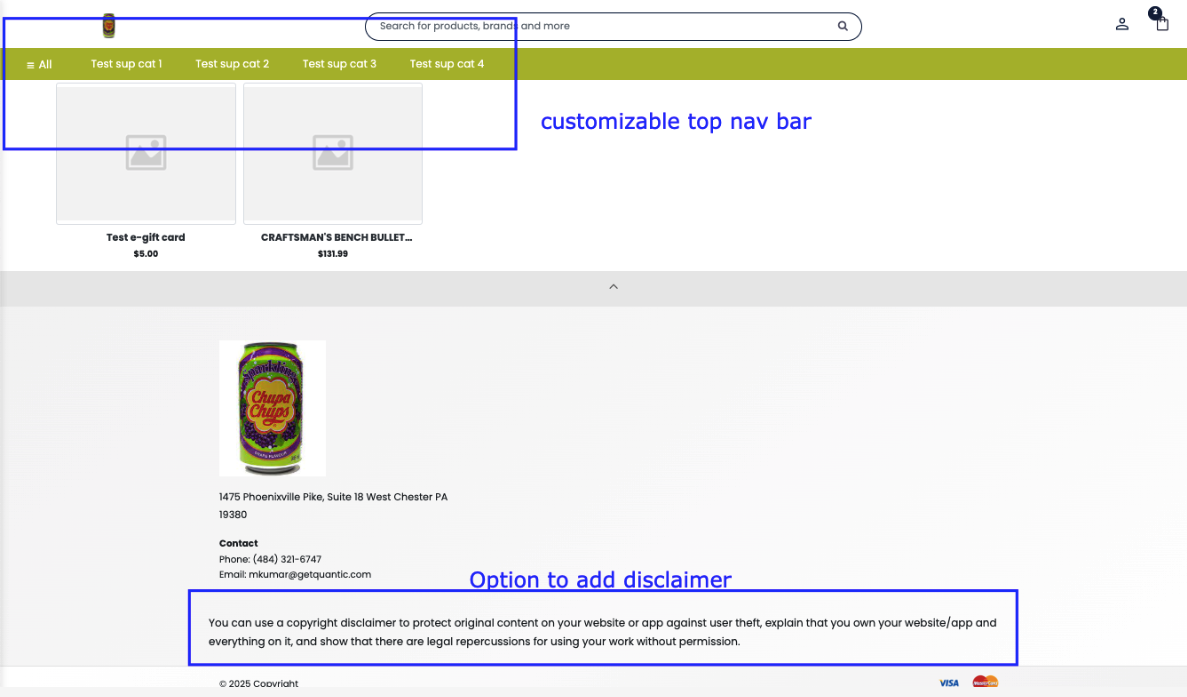

Retail E-commerce Enhancements

We’ve introduced several updates to improve the shopping experience for both customers:

- Scrollable Category List: A scroll bar has been added to the category listing that appears when clicking “All” on the top navigation bar, making it easier to browse through numerous categories.

- Clickable Categories for Subcategories: Categories are now clickable and will expand to show relevant subcategories, offering a more intuitive navigation experience.

- Order Note at Checkout: Customers can now leave special instructions or preferences using the new Order Note field at checkout. To disable this feature, use the “Disable Order Note” setting under: E-commerce Module > Other Settings.

- Customizable Header Color: Merchants can now personalize the e-commerce header with a color of their choice using the new Header Color setting. Available under: E-commerce Module > Other Settings.

- Disclaimer at Page Bottom Add important messages or disclaimers at the bottom of your e-commerce page. Configure this under: E-commerce Module > Footer Section.

|

|---|

| Scroll in the category listing |

| Subcategory listing |

|---|

| Customizable header color and Disclaimer option at the bottom |

|---|

| ENHANCEMENT |

|---|

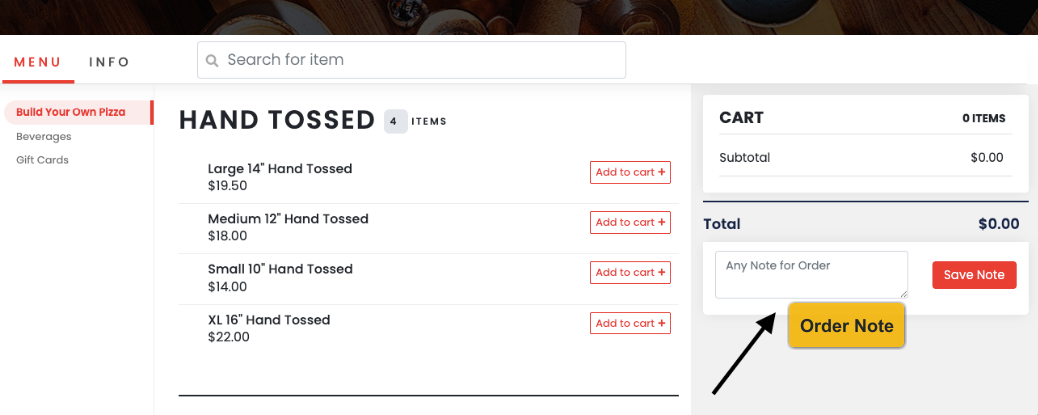

Restaurant Ecommerce – Option to Hide Order and Item Notes

Merchants can now choose to hide the Order Note and Item Note fields from their restaurant’s e-commerce interface. This helps streamline the checkout experience when customer notes are not required.

Enable this using the following settings: Disable Order Note and Disable Item Note.

Settings are available under the Ecommerce module > Settings.

|

|---|

| Option to hide Order note |

| Option to hide Item Note |

|---|

| ENHANCEMENT |

|---|

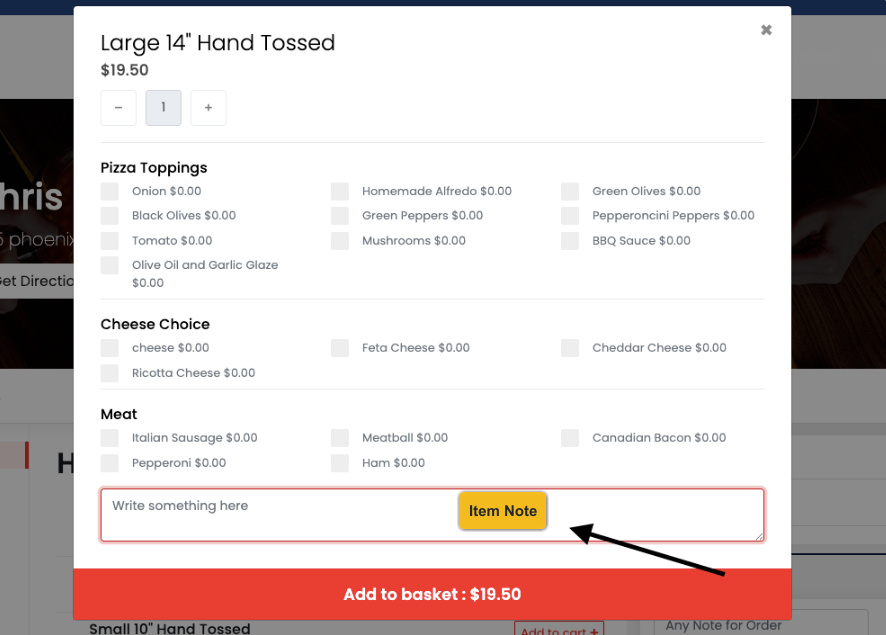

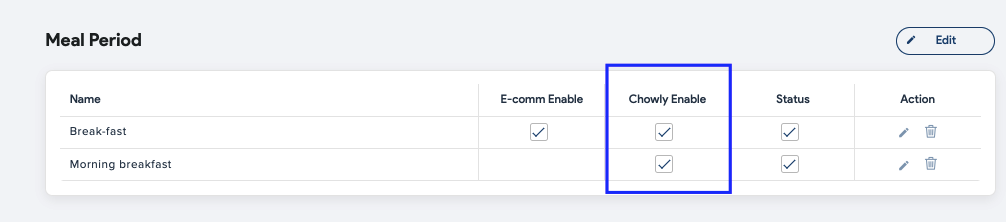

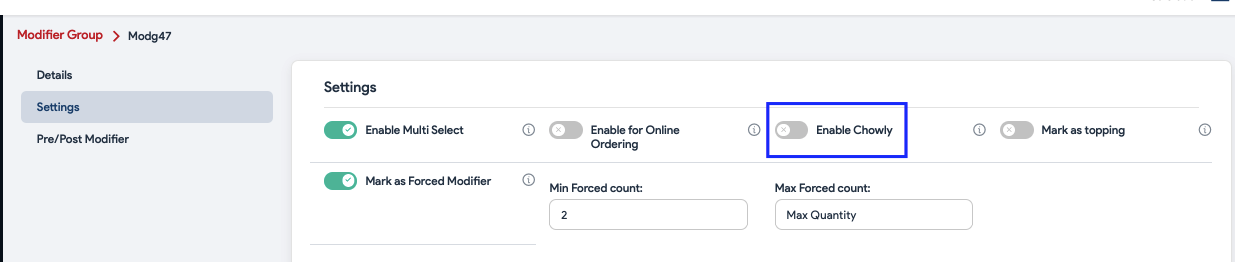

Chowly Integration Enhancements

We’ve introduced new configuration options to give merchants more control over what gets pushed to Chowly. Here are the updates:

- Chowly-Specific Meal Periods: A new “Enable Chowly” checkbox has been added to Meal Periods. Only those meal periods with this option enabled will be synced with Chowly. Location: Settings > Setup > Meal Period

- Dedicated Time Schedule for Chowly: A separate time schedule can now be maintained specifically for Chowly. Setup available under: Chowly Module.

- Chowly Controls in Modifier Group: We’ve added an “Enable Chowly” toggle in the Modifier Group section. Only Modifier Groups and individual Modifiers with this enabled will be sent to Chowly.

|

|---|

| Enable chowly for meal perod |

|

|---|

| Enable chowly for Modifier Group |

| ENHANCEMENT |

|---|

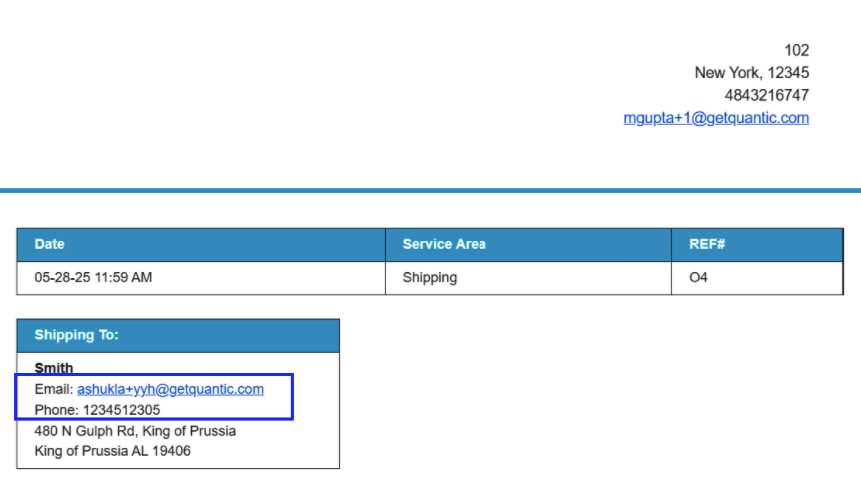

Retail e-commerce – Customer Contact Details on Emailed Receipt

The customer’s email address and phone number will now be included on the emailed receipt. These details are automatically pulled from the Shipping Details section filled out by the customer during checkout.

This enhancement helps merchants maintain accurate records and improves post-purchase communication.

|

|---|

| Email and phone on receipt |

| ENHANCEMENT |

|---|

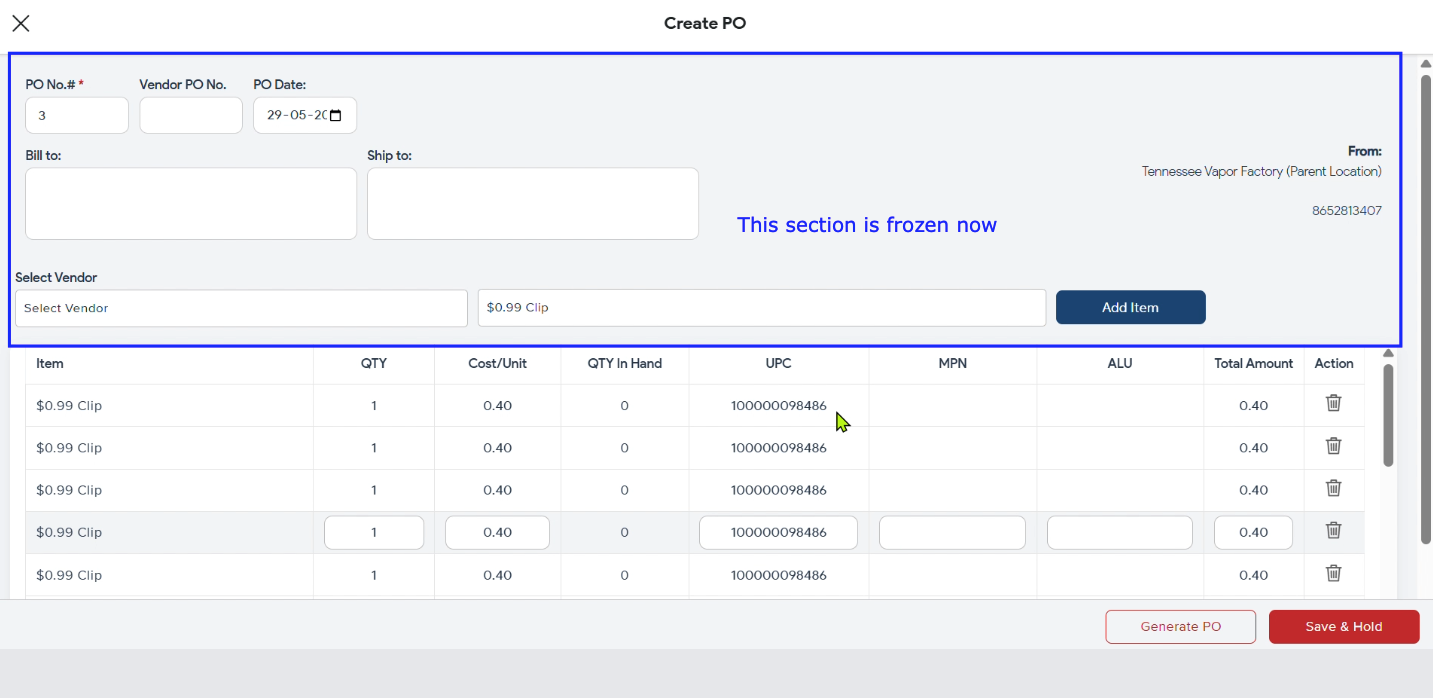

Purchase Order improvements

We’ve addressed a usability issue on the Purchase Order (PO) screen where the top section would scroll out of view as more items were added. This made it inconvenient for merchants to add new items.

To improve the experience, the topmost section of the PO is now frozen, allowing merchants to continue adding items without needing to scroll back up each time.

|

|---|

| Topmost section is frozen now |

ENHANCEMENT

Restaurant Ecommerce – Improved Tip application

Entering a tip on the e-commerce checkout page is now more seamless. Once a customer enters a tip amount, it will automatically apply to the cart when they click anywhere on the page.

This ensures a smoother and faster checkout experience.

Feature Updates

Release Date : 15th April 2025

Product Enhancements

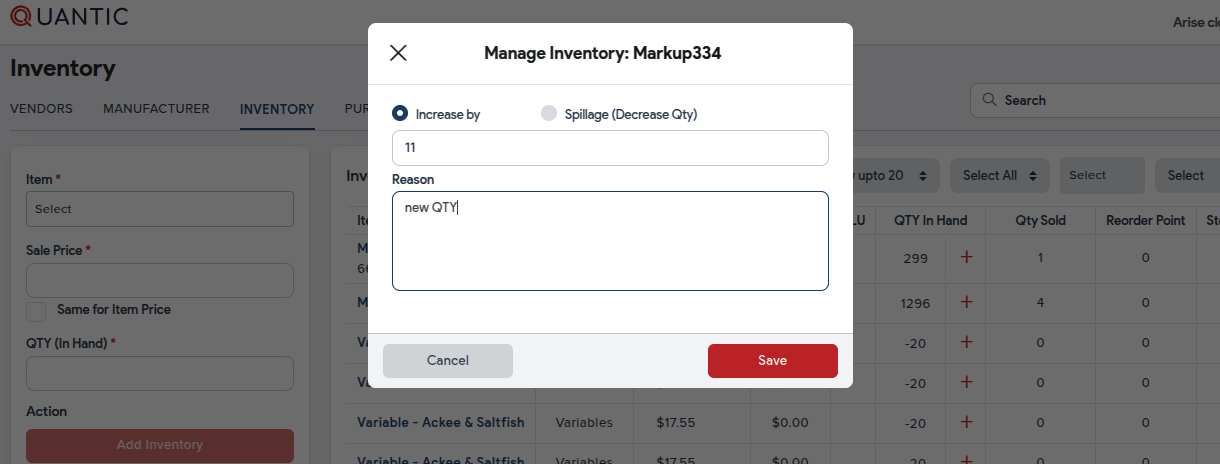

Inventory Adjustment Reason

We’ve introduced a new feature in the Backend Portal that allows merchants to add a reason when adjusting (increasing or decreasing) inventory. Once entered, the reason will be recorded and displayed in the Stock History section of the Inventory module for future reference.

Note: This is a configuration-based feature. To use it, please ensure the “Enable Inventory Reason” setting is enabled.

This enhancement improves traceability and transparency in inventory management.

Inventory adjustment reason

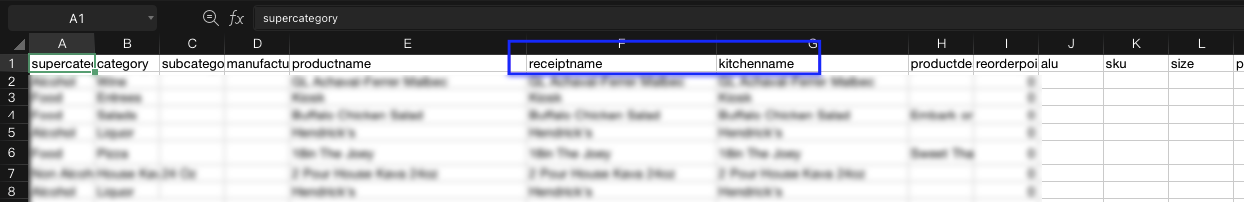

Upload the Receipt and Kitchen Name via CSV Sheet

Merchants can now upload Receipt and Kitchen Name details directly to the catalog using the CSV upload feature. Two new columns — Receipt and Kitchen Name — have been added to the CSV template.

To use this feature:

- Download the updated CSV template.

- Fill in the item details along with the Receipt and Kitchen Name fields.

- Upload the completed file.

- The data will automatically reflect in the Backend Portal.

This update streamlines catalog management and enhances data accuracy.

Inventory adjustment reason

Feature Updates

Release Date : 31st March 2025

- New Tax Exempt report

- Improvements in the Markup/Margin

- Payroll Report – Custom File Number and Payroll ID

- Flat Tax is now supported in the Portal and POS

- CRM – Mountain Time without DST supported

Product Enhancements

ENHANCEMENT

New Tax Exempt report

Introducing a new Tax Exempt report which displays the tax exempted at an item or the order level along with the name of the employee who took that order. Here are the details:

- Ref# – Order ref# which has been exempted from tax.

- Date – Date of the order taken

- Type – Tax exempted at Item or Order level.

- Emp Name – Name of the employee who took the order.

- Exempt Amount – The tax amount that has been exempted.

|

|---|

| Tax Exempt Report |

| ENHANCEMENT |

|---|

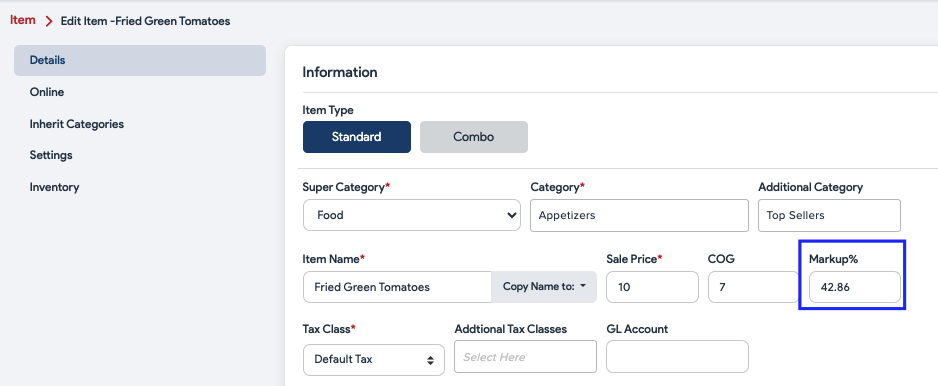

Improvements in the Markup/Margin

We’ve found that the Markup was being wrongly called the Margin in the Portal and the POS. So now we have replaced Margin with Markup, however the calculation remains the same. Below is a way to calculate the Markup and Markup%:

Markup = Selling Price – COG

Markup % = (Markup / COG) × 100

In addition, we have added a new feature called Margin which will be calculated based on the Selling Price. Below is a way to calculate the Margin and Margin%:

Margin = Selling Price – COG

Margin % = (Margin / Selling Price) x 100

The default setup is Markup. You can switch the calculations using a setting – Show Profit Report Based On. The calculations will reflect on the Item section (POS and Portal) and the Profit Margin report.

|

|---|

| Improvements in the Markup/Margin |

| ENHANCEMENT |

|---|

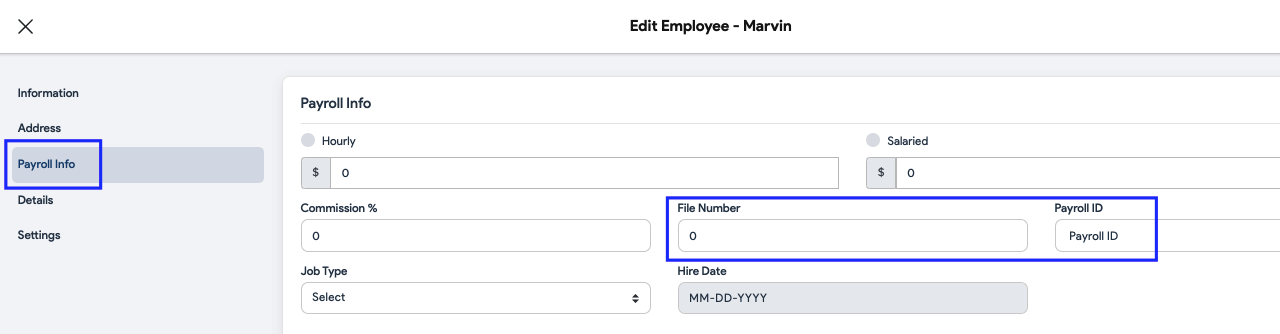

Payroll Report – Custom File Number and Payroll ID

Now you can customize the name for the File Number and the Payroll ID in the Payroll report. “Custom File Number Name” and “Custom Payroll ID Name” are the settings that you can use to change the text for File Number and Payroll ID. Please note that you can fill in the File Number and the Payroll ID from the Employees > Edit Employee > Payroll Info. Also, please make sure to enable the setting – Enable PayrollID in reports to display the file number and payroll ID info in the Payroll report.

|

|---|

| File Number and Payroll ID |

| ENHANCEMENT |

|---|

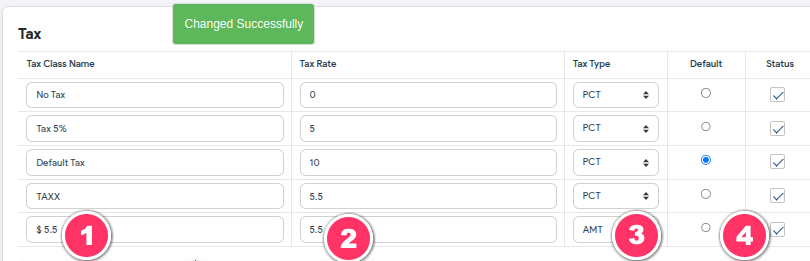

Flat Tax is now supported in the Portal and POS

Flat tax is now supported in the POS. Flat tax can be set up from the Backend portal > Settings > Setup > Tax. Add the tax, set the rate, and select AMT in the Pay Type. Once done you can set the tax at the category or item level.

Key points to note:

- Flat tax can only be setup from the Portal.

- Flat tax cannot be setup from the Partner Portal.

- Flat Tax cannot be applied as an additional tax.

- Flat tax is not yet supported for ecommerce.

|

|---|

| Setting Disabled – Date and time appeared |

| ENHANCEMENT |

|---|

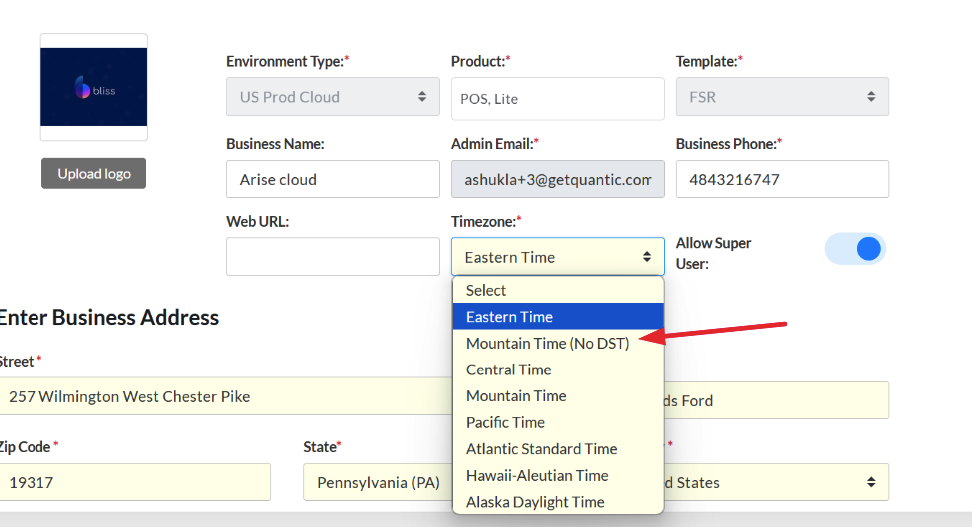

CRM – Mountain Time without DST supported

We have added a new timezone called Mountain Time (No DST), especially for merchants in Mountain Timezone states that do not follow daylight saving time —for example, Arizona. Merchants can select the timezone while creating a location in the Partner Portal.

|

|---|

| Mountain Time (No DST) |